Dave Ramsey, America’s most influential personal finance guru, drives a pickup truck that, he says, will eat your electric car. He wears a .45 on his hip with a hollow-point in the chamber. He is an older white male, a self-described “capitalist pig”, and an evangelical Christian who almost always votes conservative. He hates government intervention in his life – and yours.

His mortal enemy, however, is personal debt, and he has spent the last three decades on a crusade against modern usury, in the form of credit card companies (scum), payday lenders (the scum of the earth), and debt collectors (“some good people”, but largely “complete scum”).

Ramsey believes that as long as you have one red cent of debt – credit card debt, student loans, car payments, mortgages, medical bills – you can never be free. The day you take scissors to your credit cards is the beginning of your financial salvation.

Three hours a day, five times a week, 16 million people tune into the Dave Ramsey Show, Ramsey’s decades-running radio program, for his financial counsel. It is the third biggest talk radio program in the country, after only Rush Limbaugh’s and Sean Hannity’s. Unsurprisingly, his following includes a growing number of debt-burdened millennials.

Ramsey has been described as the “financial whisperer to Trump’s America”, an interlocutor for struggling people forgotten by coastal corridors of power. Critics argue that his worldview ignores the structural economic reasons so many Americans are in debt, such as higher education and healthcare costs, and encourages them to view indebtedness as a personal failing.

But if his fans are to be believed, Ramsey has saved their lives, helping them to pull themselves, bootstrap by bootstrap, out of indebtedness and poverty. His seven-step program is taught widely at churches, schools, corporations and military bases. His audience is likely to grow even further in future years. Americans currently owe more than $14tn in consumer debt. Of that, $372bn is at least 90 days late and considered seriously delinquent. The average American owes $6,194 in credit card debt, and Americans owe a collective $1.6tn in student loans.

As Ramsey sees it, America’s debt crisis is an epidemic akin to drug addiction, and its roots lie in individual behavior. The only way to escape its crushing weight is to stop enabling yourself and go cold turkey: live on rice and beans, get a second job, sell your money-sucking car. On Twitter, he dispenses tough-love commandments:

“If you’re working on paying off debt, the only time you should see the inside of a restaurant is if you’re working there.”

“If you come to work late and they are paying you, then you are stealing. Don’t steal and expect to get promoted.”

And God help you if you’re waiting for the government to rescue you. It won’t, he says – and shouldn’t.

Your debt is on you.

• • •

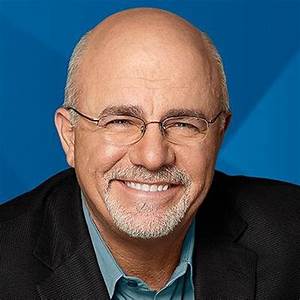

Ramsey, who recently celebrated his 60th birthday by skydiving, is short and bald, not unhandsome, with a trim beard closer to white than grey. He spends most mornings at his 47-acre corporate headquarters outside Nashville, managing his media empire, Ramsey Solutions, which employs 900 people. In the afternoon, shortly before his show goes live, he and some staffers gather for a prayer. Then he sits at his desk, waits for the phone to ring, and spends the next three hours as an air traffic controller for America’s collective financial anxiety.

On a recent Thursday, Roxanne in Tampa calls for advice on her situation. Ramsey is in a mellow mood today, which is good, because Roxanne’s question will turn out to be a whopper.

Roxanne is an assistant principal at a public school, and has “a lot” of student loans. She’s wondering whether she should aggressively pay her student debt, or hold off, because she’s heard of a federal program for public servants “where, if you pay for 10 years, you get the rest of your loans forgiven –”

“No, you don’t,” Ramsey cuts in. “It was a scam. Have you not read the articles? Ninety-five thousand people have applied for it, after their 10 years of service. Eighteen people have had their loans forgiven. Everyone else was denied.” (A recent Department of Education report says that more than 170,000 people have applied; 3,233 – or 1.89% – have been forgiven.)

Roxanne processes this information.

Ramsey asks: “How much debt have you got?”

“It’s about $200,000,” Roxanne says.

There’s a silence before Ramsey speaks. “Oh, my goodness.”

He asks her income.

“About $63,000.”

Even Ramsey seems at a loss. “That is a small shovel in a big hole,” he says in his Tennessee drawl. “Your return on investment – $200,000 invested to get a $63,000 job – was horrible.”

He adds: “I’m sorry for that. I’m glad you’re an assistant principal, and that people like you are serving. I’m very sorry that you’re that far in debt to get that kind of an income. It’s gonna take you a little while, kiddo. I would not be waiting on the government to do it. I’d just start chipping away at it, and figuring out what I can do to get my income up, and attack it as fast as you can. That’s distressing.”

Ramsey’s “baby steps” for getting out of debt are intentionally idiot-proof: create a household budget (“give every dollar a job”); cut all non-essential expenses (“eat beans and rice, rice and beans”); set aside $1,000 as an emergency fund; and then throw every cent you can at your debt, including, if need be, by raiding your savings, taking on a second or third job, or forgoing retirement payments.

A crucial element is the willingness to be, as Ramsey likes to put it, “weird”. Your friends will think you’re eccentric because you never go out to dinner with them; a co-worker may wonder why you make more money but drive a worse car. You should relish this weirdness, he argues. You should take pride.

In more caffeinated moods, Ramsey likes to rail against naysayers. In one video with 2.5m views, he affects the sniveling tone of one of his critics.

“‘Well, Dave,’” says the imagined sniveler, “‘you don’t know about my situation. American day wages are stagnant.’

“You know where wages are stagnant?” Ramsey replies, his voice growing into a thunder. “On people who are stagnant. You’ve only got stagnant wages if you decide to stay there and keep getting those wages. This is not Russia, you can quit.

“‘I don’t like how much Walmart pays.’ ‘I don’t like how much McDonald’s pays.’ So don’t work there, stupid. Go work for somebody else.

“‘I don’t like how my company treats me.’ So leave. Go be somebody.

“You need to leave the cave, kill something and drag it home.”

•••

Like all great motivational coaches, Ramsey has an origin story of tragedy and triumph, having lived through the misery of debt first-hand.

He grew up in Antioch, Tennessee. His father was a builder, his mother a realtor. They were enthusiasts for that most American of literary genres, self-help. According to the Nashville Scene, an alt-weekly newspaper, Ramsey’s parents often played tapes of motivational speakers as they drove to family vacations.

If you want to read more you can click on below link:

Credit to Guardian.com